Introduction

Once, why Warren Buffett called compound interest the “eighth wonder of the world”? Picture this: A single $100 investment growing to $1.4 million over 100 years at 10% annual returns. That’s not magic—it’s compound interest. And with our free compound interest calculator, you can compute compound interest scenarios in seconds. This math isn’t just for Wall Street wizards. Farmers, teachers, and even teenagers are using it to build generational wealth. In this guide, you’ll learn how to harness this “wealth multiplier,” avoid critical mistakes, and estimate compound interest like a pro.

Table of Contents

What is Compound Interest? (The “Snowball Effect” Explained)

Compound interest is earning interest on your interest. Unlike simple interest (which only grows your principal), compounding reinvests earnings, creating exponential growth.

Real-World Example:

- $10,000 invested at 7% for 30 years:

- Simple interest: $10,000 + ($10,000 × 0.07 × 30) = $31,000

- Compound-interest: $76,122 (over 2.4× more!)

Why This Matters:

Einstein famously called compounding “the most powerful force in the universe.” Even tiny contributions snowball over time. A 25-year-old investing $300/month at 8% interest would have $1.2 million by age 65.

The Jaw-Dropping Math Behind Compounding

The Compound-Interest Formula Demystified

The formula looks intimidating but is simple:

A = P(1 + r/n)^(nt)

- A = Future value

- P = Principal (initial investment)

- r = Annual interest rate

- n = Compounding periods per year

- t = Time in years

Practical Breakdown:

Invest $5,000 at 6% interest compounded monthly for 20 years:

A = 5000 × (1 + 0.06/12)^(12×20) = $16,551

The Rule of 72: Your Quick Wealth-Doubling Cheat Code

Divide 72 by your interest rate to estimate doubling time:

- At 6% returns: 72 ÷ 6 = 12 years to double your money

- At 9%: Just 8 years!

Why Starting Early is Your #1 Wealth Superpower

Stunning Statistic:

A 25-year-old who invests $200/month until 65 at 7% will have $525,000. If they start at 35? Just $245,000—less than half! (Source: SEC Compound Interest Study)

The “Cost” of Waiting:

| Start Age | Monthly Investment | Value at 65 (7% return) |

|---|---|---|

| 25 | $300 | $787,000 |

| 35 | $300 | $364,000 |

| 45 | $300 | $151,000 |

Pro Tip: Use our Age Calculator to see how many compounding years you have left.

How to Compute Compound Interest Like a Pro

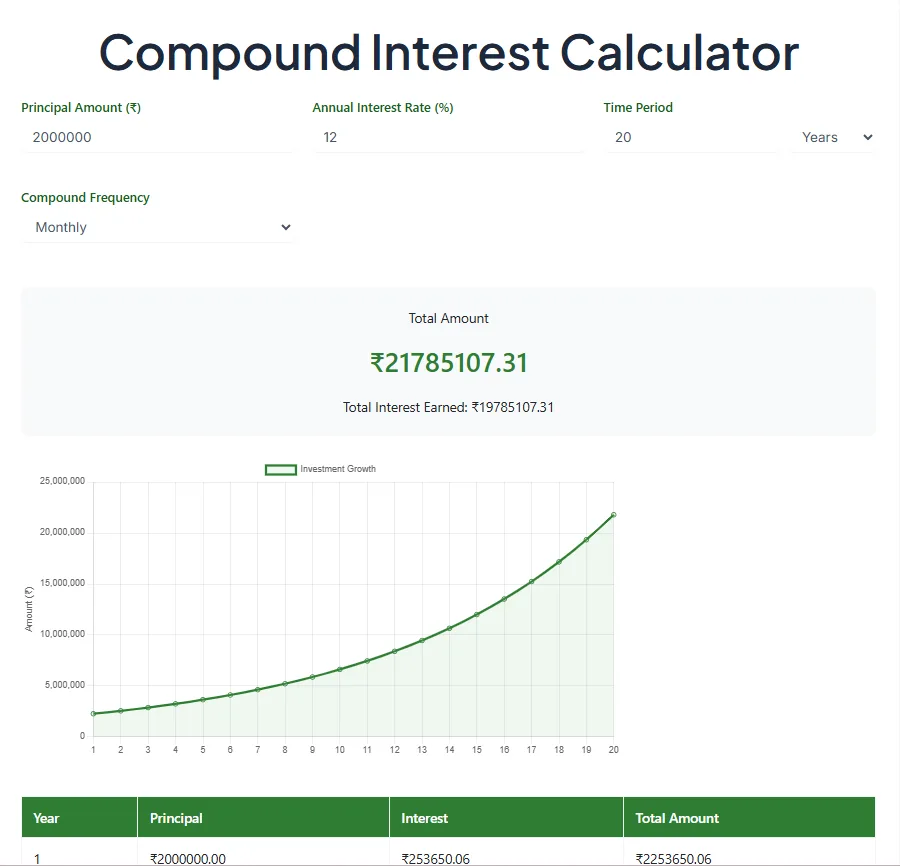

Using Our Free Compound Interest Calculator

Our compound interest calculator lets you estimate compound interest growth in 3 clicks:

- Enter initial investment (e.g., $1,000)

- Add monthly contributions (e.g., $100)

- Adjust interest rate (e.g., 6%) and timeline (e.g., 30 years)

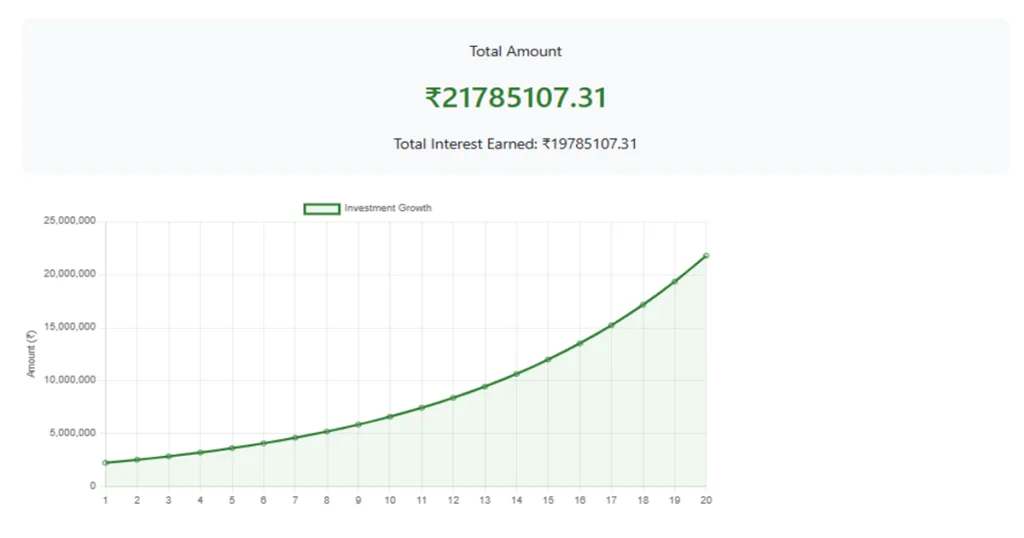

Real Output Example:

$1,000 + $100/month at 6% for 30 years = $113,000

Variables That Explode Your Growth:

- Time: Adds exponential curves (see graph below)

- Rate: A 2% difference can mean $500,000+ over 40 years

- Consistency: Investing monthly beats lump sums

Manual Calculation Walkthrough

Calculate compounding annually on $2,000 at 5% for 3 years:

- Year 1: $2,000 × 1.05 = $2,100

- Year 2: $2,100 × 1.05 = $2,205

- Year 3: $2,205 × 1.05 = $2,315

5 Powerful Steps to Maximize Compounding (Action Plan!)

- Start NOW: Open a Roth IRA or brokerage account today.

- Automate: Set monthly transfers (even $50 counts!).

- Reinvest Dividends: Turbocharge growth (e.g., DRIP plans).

- Avoid Debt: Credit cards at 20% APR destroy compounding.

- Track Progress: Use our compound calculator quarterly.

Case Study:

Sarah, 28, invests $250/month in index funds (avg. 9% return). By 60, she’ll have $735,000. If she ups it to $500/month? $1.47 million.

Critical Traps That Sabotage Compounding

- Inflation: Erodes 2-3%/year. Aim for returns >6%.

- Fees: A 1% management fee can cost $590,000 over 40 years (DOL study).

- Taxes: Use tax-advantaged accounts (401(k), Roth IRA).

- Panic Selling: Missing the market’s best days slashes returns by 50% (J.P. Morgan data).

Defense Strategy:

Check fees with our Percentage Calculator. Optimize loans with our EMI Calculator.

Beyond Savings: Where to Invest for Explosive Growth

- S&P 500 Index Funds: Avg. 10% annual returns since 1926

- Rental Properties: Leverage appreciation + rental income

- Dividend Stocks: Reinvest payouts for accelerated compounding

- High-Yield Savings: 4-5% APY (FDIC-insured)

Historical Fact:

$10,000 in the S&P 500 in 1980 would be $1.2 million today (CNBC Analysis).

Compound Interest in Debt: The Dark Side

Credit cards compound against you:

- $5,000 balance at 20% APR = $6,000 owed in 1 year

- Minimum payments can trap you for decades

Fix It Fast:

Use our EMI Calculator to crush debt.

3 Real-Life Millionaire Stories Fueled by Compounding

- The Janitor ($8M Secret): Ronald Read invested consistently in blue-chip stocks for 70 years.

- The Teacher: Grace Groner turned $180 into $7M via Abbott Laboratories stock.

- The Coffee Farmer: Started with $10/day in Kenyan coffee cooperatives.

Tools to Supercharge Your Journey

- Compound Interest Calculator: Estimate growth

- Investment Trackers: Personal Capital, Mint

- Education: Investopedia’s Compounding Guide

- Tax Optimization: IRS.gov retirement resources

Don’t Forget: Try our QR Code Generator to save investing resources!

FAQs: Your Burning Questions Answered

Q: Can compound interest make me a millionaire?

A: Absolutely! $500/month at 8% for 35 years = $1.1M.

Q: How often should interest compound?

A: Daily > monthly > annually. Daily compounding adds 5-10% more over decades.

Q: Is stock market compounding reliable?

A: Historically, yes. S&P 500 averaged 10% for 100 years (including crashes).

Conclusion: Your Path to Financial Freedom Starts Now

Compounding isn’t a “get-rich-quick” scheme—it’s a “get-rich-sure” strategy. The key? Start early. Stay consistent. Let math do the heavy lifting. With our compound interest calculator, you can estimate compound interest growth risk-free today. Remember: The best time to plant a money tree was 20 years ago. The second-best time? Right now.

Outbound References: